By building strategic relationships with industry leaders around the world, we have found that our work as investors and that of corporate innovators are very similar and require a similar approach. Based on this, we have successfully introduced the Venture Engine® methodology for open innovation to several of our corporate partners in the last few years. Here is how it works.

Global transitions are fueled by founders and amplified by industry leaders

Unknown Group invests in purpose-driven founders worldwide who are developing solutions that support the critical, global transitions of the coming decades. Such as the energy transition, the food transition, and the healthcare transition.

We strongly believe that these transitions will be fueled by founders and amplified by industry leaders. That’s why we define our investment areas in close collaboration with our corporate partners and actively support industry leaders and ventures to jointly develop impactful solutions.

Better bets and bottom line results: The Venture Engine™ for open innovation

While the value of industry partnerships for ventures is clear, industry leaders have just as much to gain. When done right, open innovation can deliver bottom line results faster, cheaper and with lower risk compared to internal innovation projects.

Moreover, no single company could implement even a fraction of the millions of ideas, products and technologies that ventures work on every day.

Many executives would agree that realizing the full potential of the global startup and scale-up world remains a challenge. Bad deal flow, differences in culture and scale, and a lack of internal coordination and mandate often kill joint projects before any impact was made.

Our Venture Engine® methodology addresses many of these challenges. It enables industry leaders to effectively turn their collaborations into bottom line results.

The Venture Engine® methodology

For Unknown Group, the Venture Engine® methodology creates broad funnels with emerging ventures in relevant strategic domains, out of which we can make the best bets.

In addition, the model optimizes our return on investment for these bets by providing key assets for further growth: Ecosystem connections, capital, and industry access.

For industry leaders, the Venture Engine® effectively turns their venture collaborations into bottom line results, by enabling them to work with the best, and creating a long-term internal commitment towards these collaborations.

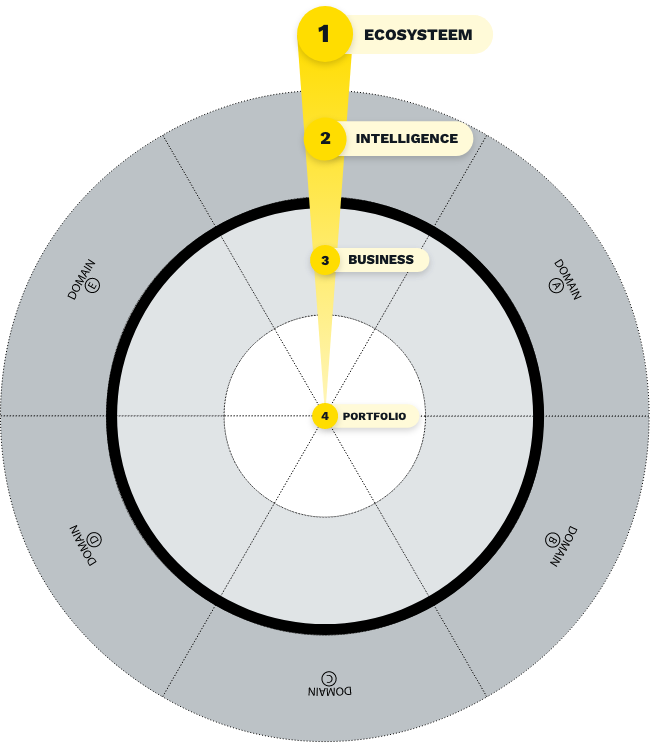

The model works on 4 dimensions: Ecosystem, Intelligence, Business and Portfolio.

1. Ecosystem

To make the best bets, we need to know the best ventures. To some extent, these ventures can be uncovered through active scouting. However, this will only reveal ventures that match the predefined search criteria.

Since the search criteria are always defined based on the current state of knowledge, the solutions will never surprise. While, in our experience, the Unknown ventures are many and high-potential. The only way these ventures become known is if they get in touch themselves.

Therefore, industry leaders should spare no effort to make it quick and easy for them to get in touch by being a go-to-brand for ventures in the global startup ecosystem.

A successful presence in the ecosystem gives companies deep access in- and deal flow from – the startup ecosystems they target.

Combined with a clear value proposition to ventures and a well-defined path into the company, strategically relevant ventures from all parts of the world can easily get in touch.

2. Intelligence

The massive deal flow that a successful ecosystem presence leads to is a critical asset in selecting the best ventures to collaborate with. But an abundance of potential collaborations also complicates this task.

Selecting the best collaborations out of a wealth of deal flow can only be organized as a data-driven activity. Intelligence is about using technology to get ahead of emerging trends and connect with the best ventures.

In the early stages when ventures make contact, several factors determine the potential for collaboration. For many of these factors, such as an excellent founding team and a solid problem-solution fit, traction is the best validation.

We have found that the pace at which ventures progress, both financially and in terms of other development goals, has predictive value for their eventual success.

Established databases like CB Insights and Crunchbase do a great job documenting investment rounds and revenues. But to make the best bets, you need deeper traction information.

Since most early-stage ventures do not publish this information, it needs to be captured in a dialogue. Organizing this dialogue at scale requires technology and a clear reason for ventures to participate: Business and funding opportunities.

The traction data collected, as well as the emerging technology and business model trends that can be derived from this data, will enable the best bets in strategic domains.

3. Business

The decision to engage is mutual. The best ventures are as selective about who they work with as industry leaders are.

The extent to which industry leaders can help them grow is key to their decision to collaborate. To partner with the best, industry leaders must provide the best value.

This value is a fast and effective way to move from proof-of-concept to scalable and mutually valuable collaboration. The skills required for collaboration should exist in both the innovation department and the business units where the collaboration will eventually scale.

Transparent, objective and milestone-based decision making, as well as realistic procurement and compliance processes and great communication, are critical.

In addition, strategic positions in collaborations are created, as well as a front row seat for follow-up investments and acquisitions.

4. Portfolio

The best way to ensure this internal engagement is to align the interests of ventures and industry leaders early on. Investing at an early stage, creates a strong incentive to make collaborations work throughout the company.

In addition, you create a strategic position in collaborations and secure a front row seat for follow-on investments and acquisitions.

However, early stage investing is a high-risk, high-reward activity that does not fit in corporate governance, decision-making and risk-attitude. For this reason, ventures should be very critical when it comes to taking funding from a corporate investor early on.

For early-stage investments to work, industry leaders should not invest from the business, but from a separate investment vehicle. An opportunity fund positioned outside the company and managed by early-stage investment experts.

This opportunity fund creates a large portfolio of early-stage ventures and serves as a funnel for validated deal flow for corporate venture capital (CVC) and mergers and acquisitions (M&A).

BENCHMARK YOUR VENTURE COLLABORATION STRATEGY

Participate in our benchmark research and compare your performance to other industry leaders. You will receive a personalized report with actionable advice to improve your open innovation and venture collaboration strategy.

Explore the Venture Engine® for open innovation with Unknown

Unknown Group is an early-stage venture capital firm headquartered in the Netherlands with local offices in Europe, Southeast Asia, the US and Latin America.

Our Venture Engine® for open innovation effectively turns venture collaborations into bottom line results through a combination of ecosystem, intelligence, business and portfolio activities. Over the past 14 years, we have built assets across these four dimensions. Industry leaders can leverage these assets to accelerate their collaborations.