Last month, we shared insights into how the Venture Engine® supports industry leaders to turn venture collaborations into bottom line results. A strong startup ecosystem presence is crucial to our Venture Engine® methodology. In this article we will share the 3 best practices to become a go-to brand for ventures in your strategic domains: Position, Network and Attract.

Why it is important to become the go-to brand for innovation ventures in your strategic domains

Emerging ventures bring new technologies and business models that industry leaders need to stay ahead of the competition. By having a strong ecosystem presence, you become approachable for startups. Below you can find an example of how we started collaborating with Gashouders out of our ecosystem presence.

The power of the ecosystem: A case on how a circular biogas startup found their strategic partner for funding and scalable market access

At the beginning of this year, we invested in Gashouders, a Dutch venture that is reducing carbon emissions and fossil fuel usage by making biogas out of waste streams available to the industry.

The energy transition is one of the key domains in which we support impactful ventures with funding and scalable market access. Therefore, our startup analysts closely monitor emerging trends in the space, and we meet new energy ventures every day.

However, trend analysis is done on large amounts of data and can never cover every individual use case. Circular biogas was not on our radar before the Gashouders team walked into our office, and we would have never invested in this niche if they hadn’t.

Mark Deutekom, Global Energy Director at Unknown Group: ‘It was great to meet the Gashouders team and learn more about their impactful circular biogas solution. We share huge ambitions, and we are excited to fuel the energy transition together.’

This is the power of a strong ecosystem presence for investors, but even more so for industry leaders. If you are top of mind for startups in your strategic domains, you will be the first to learn about the innovative technologies and use cases they bring. Use cases you could never search for in startup databases like CB Insights and Pitchbook, simply because it is impossible to scout without defined search criteria.

However, the startup ecosystem is crowded and thousands of industry leaders, investors, accelerators, and other players are targeting the same ventures as you. In our experience, the following three practices make you stand out in the ecosystem as the go-to brand for innovative ventures in your strategic domains.

1. Position

A key element to a strong ecosystem presence is having a clear and attractive value proposition for ventures. Ventures are looking for partners who can help them grow, by providing knowledge, facilities, production, traction, distribution, and funding. A good value proposition describes a superior promise on one or more of these topics.

Over the last years we have seen ventures becoming increasingly critical about the partners they want to work with. And they have all the reasons to be so.

Most founders we know have spent large amounts of time and resources applying for innovation challenges and attending programs that turned out to be worthless for their business. Therefore, formulating an attractive value proposition alone is not enough.

A strong ecosystem presence doesn’t happen overnight. If you fail to deliver upon your value proposition, ventures will stay away in the future.

Demonstrating proof that you will deliver, for example in the form of successful collaboration cases, will help to build credibility in the ecosystem and will make ventures eager to work with you.

Pieter Mans, CEO of Gashouders: ‘We initially approached Unknown Group because we were looking for support getting ready for a new investment round. We could have turned to one of the Big Four for this, but we wanted a partner that shares our entrepreneurial culture. Furthermore, it was clear to us that Unknown Group could support us with fundraising and business development as well.’

2. Network

To enable the best ventures to get in touch with you, your message needs to reach them. Building a strong online presence and leveraging all relevant channels to get the word out gets you a long way. But to reach all the relevant ventures in an ecosystem, you need to work together.

The startup ecosystem is dense and full of organizations like incubators, accelerators, technology labs, and investors. Their shared ambition is to help ventures succeed throughout various stages of their growth.

If you do it right, your value proposition will be complementary to the ones of many of these network partners. This means that there is value for them to refer targeted ventures out of their networks to you.

These kinds of exchanges do not only support the best ventures to get in touch with you. They also support a stronger and better mobilized startup ecosystem.

The best and most relevant ventures in your strategic domains can come from anywhere. Therefore, the more network partnerships you build, the better.

Becoming a go-to brand: how building a network of partners can get you in touch with the best ventures

We exchange value with more than 300 network partners through Get in the Ring, our global pitch competition. On top of that, we build dense networks of partners in our focus regions and domains.

Gashouders got in touch with us via ION+. This is an investor targeting the early-stage funding gap for innovative ventures in the east of the Netherlands. ION+ referred Gashouders to us and we ended up investing in the company together.

3. Attract

A great value proposition and strong network partners will increase the number of great ventures getting in touch with you. However, it is difficult to plan your innovation roadmap around these spontaneous interactions. To align your innovation activities with the ecosystem, you need to support ventures to reach out at the right moment.

This can be done through open innovation challenges. Calls for applications for ventures in a specific domain you are working on at that moment. By setting an application deadline, the open innovation program you organize for these ventures becomes plannable.

The power of open innovation challenges: An example of how Shell attracts the best startups and scale-ups in their domains

A great example is the Shell New Energy Challenge, which we have supported since 2016. The New Energy Challenge runs annually, and each year Shell is calling out to new energy startups and scale-ups to apply.

In the coming weeks, we will publish a case describing how Shell is combining Position, Network and Attract to leverage the power of the ecosystem.

To select the best ventures to work with, great Ecosystem presence must be complemented with Intelligence activities. In the following article we will deepdive on the next Venture Engine dimension: Intelligence.

Explore the Venture Engine® for open innovation with Unknown

Unknown Group is an early-stage venture capital firm headquartered in the Netherlands with local offices in Europe, Southeast Asia, the US and Latin America.

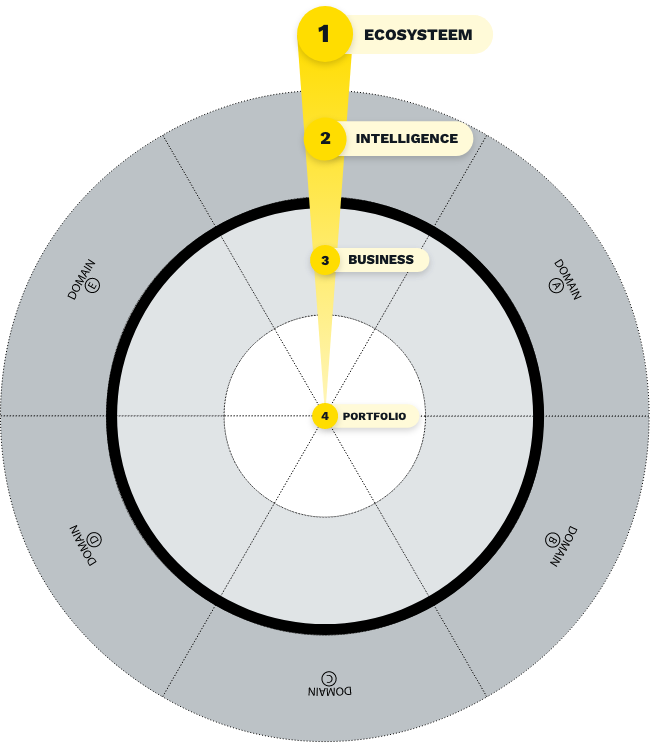

Our Venture Engine® for industry leaders effectively turns their collaborations into bottom line results through a combination of ecosystem, intelligence, business and portfolio activities. Over the past 14 years, we have built assets across these four dimensions. Industry leaders can leverage these assets to accelerate their collaborations.

BENCHMARK YOUR VENTURE COLLABORATION STRATEGY

Participate in our benchmark research and compare your performance to other industry leaders. You will receive a personalized report with actionable advice to improve your open innovation and venture collaboration strategy.